Contents:

PennantPark doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. There may be delays, omissions, or inaccuracies in the Information. The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. Ideally, training at your company is a system that creates real long-term change, rather than an event that makes people feel good and then is soon forgotten after the program concludes.

BDC Weekly Review: Market Drop Deflates Higher-Valuation BDCs – Seeking Alpha

BDC Weekly Review: Market Drop Deflates Higher-Valuation BDCs.

Posted: Sat, 18 Mar 2023 07:00:00 GMT [source]

Access advanced stock screeners, portfolio monitoring tools, proprietary research reports, and more. Five companies, including a biotechnology company and a pipeline operator, unveiled share offerings after hours Monday, sending shares lower. Biotechnology company Neptune Technologies & Bioressources Inc. (NEPT, NTB.T) pl… The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.PNNT has a Quality Grade of C, ranking ahead of 70.7% of graded US stocks.

New what is ecommerces by Delivery Hero in grocery delivery start-ups is not on the agenda, according to the company’s chief executive. PNNT has a forward dividend yield of 12.55%.SeePNNT’s full dividends and stock split historyon the Dividend tab. The company is scheduled to release its next quarterly earnings announcement on Wednesday, May 10th 2023. Based on EPS estimates, PennantPark Investment will have a dividend payout ratio of 91.36% in the coming year. This indicates that PennantPark Investment may not be able to sustain their current dividend.

Best Income Stocks to Buy for January 17th

Stocks with similar financial metrics, market capitalization, and price volatility to PENNANTPARK INVESTMENT CORP are FSK, NMFC, OCSL, GBDC, and BCSF. The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest.

- To see all exchange delays and terms of use please see Barchart’s disclaimer.

- More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

- PennantPark Investment Corporation is a business development company which principally invests in U.S. middle-market private companies in the form of mezzanine debt, senior secured loans and equity investments.

- High-growth stocks tend to represent the technology, healthcare, and communications sectors.

- That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style.

- Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings.

The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. The company’s average rating score is 2.50, and is based on 1 buy rating, 1 hold rating, and no sell ratings. While the effectiveness of this highly sought-after metric is questionable, the positive… The average of price targets set by Wall Street analysts indicates a potential upside of 30.6% in PennantPark .

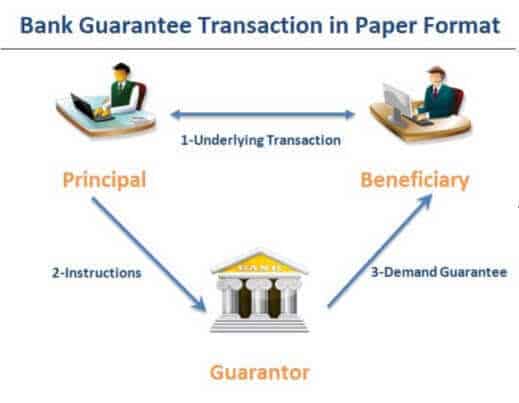

Debt

Live educational sessions using site features to explore today’s markets. PNNT, MITSY and ASR made it to the Zacks Rank #1 income stocks list on January 17, 2022. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

Consensus Price Target is the stock price analysts expect to see within a period of 0-18 months. Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous report to the most recent report. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Get MarketBeat All Access Free for 30 DaysJoin thousands of other investors who make better investing decisions with our premium tools.

A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares. Real-time analyst ratings, insider transactions, earnings data, and more. PennantPark Investment’s stock was trading at $5.75 at the start of the year. Since then, PNNT shares have decreased by 10.6% and is now trading at $5.14. While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnin…

REITs Vs. BDCs: Comparing Returns, Positioning For Higher Rates – Seeking Alpha

REITs Vs. BDCs: Comparing Returns, Positioning For Higher Rates.

Posted: Sun, 13 Feb 2022 08:00:00 GMT [source]

ComparePNNT’s historical performanceagainst its industry peers and the overall market. Our Quantitative Research team models direct competitors or comparable companies from a bottom-up perspective to find companies describing their business in a similar fashion. One share of PNTV stock can currently be purchased for approximately $0.01.

The firm seeks to invest between $10 million and $50 million in its portfolio companies. The firm may also make non-control equity and debt investments. PennantPark Investment Corporation was founded on January 11, 2007 and is based in New York, New York. Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price.

PennantPark Investment started at outperform with $8 stock price target at Raymond James

Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. Dana Auslander, a veteran hedge fund executive, is shaking up the investment world. Her company LUXUS is the first SEC-qualified alternative investment platform that allows any investor to purchase luxury jewels – previously only accessible by the uber wealthy – through fractional ownership.

Upgrade to MarketBeat All Access to add more stocks to your watchlist. One share of PNNT stock can currently be purchased for approximately $5.14. PennantPark Investment does not have a long track record of dividend growth. PennantPark Investment has only been the subject of 2 research reports in the past 90 days. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

- Sign-up to receive the latest news and ratings for PennantPark Investment and its competitors with MarketBeat’s FREE daily newsletter.

- PennantPark Investment has only been the subject of 2 research reports in the past 90 days.

- All values as of most recently reported quarter unless otherwise noted.

- Its investment objective is to generate current income and capital appreciation also seeking to preserve capital through debt and equity investments.

PNNT’s revenue has moved down $26,702,014 over the prior 70 months.The table below shows PNNT’s growth in key financial areas . For PNNT, its debt to operating expenses ratio is greater than that reported by 99.61% of US equities we’re observing. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment.

PennantPark Investment announced a quarterly dividend on Thursday, February 9th. Stockholders of record on Thursday, March 16th will be paid a dividend of $0.185 per share on Monday, April 3rd. This represents a $0.74 dividend on an annualized basis and a dividend yield of 14.40%. The ex-dividend date of this dividend is Wednesday, March 15th. This is a positive change from the stock’s previous quarterly dividend of $0.17.

PNNT Price Target

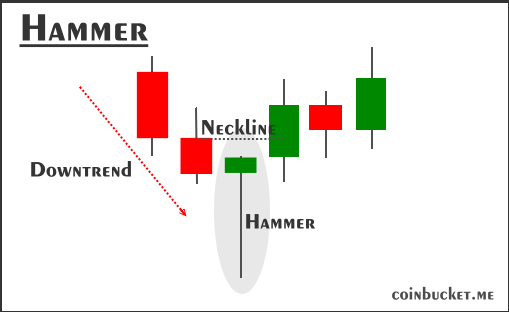

Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study.

![]()

Companies are enhancing supply chain sustainability due to new regulations and investments in green tech, with strategies including compliance, balancing impact, and redesigning the supply chain. You can help distinguish yourself in the crowded and competitive field of commercial real estate through adherence to the principles of patience, agility and diversification. With dynamic markets and uncertain economic reality, ensuring your people know what to do and how to do it is critical. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes.

GET POWR RATINGS… FREE!

Provide specific products and services to you, such as portfolio management or data aggregation. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Data may be intentionally delayed pursuant to supplier requirements. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time.

The only systemic risk to banking related to climate is not from “climate change” that occurs with much natural variation over https://1investing.in/ and space but from the climate policy responses to the hobgoblins of our own imagination. Let us not allow central bankers to be lead players in all of this. All values as of most recently reported quarter unless otherwise noted.

PennantPark Investment Corporation, a business development company is a private equity fund specializes in direct and mezzanine investments in middle market companies. It invests in the form of mezzanine debt, senior secured loans, and equity investments. The fund seeks to invest between $10 million and $100 million cross the capital structure in its portfolio companies with EBITDA between $10 to $50 million. Its mezzanine loans, senior secured loans, and other investments in its portfolio companies are between $15 million and $50 million.

A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

Sign-up to receive the latest news and ratings for Players Network and its competitors with MarketBeat’s FREE daily newsletter. Player’s Network, Inc. focuses on the cultivation and processing of medical and recreational marijuana in North Las Vegas. The company, through its subsidiary Green Leaf Farms Holdings, LLC, has Nevada state-issued medical and recreational cultivation and production licenses. It also distributes content relating to the cannabis industry at WeedTV.com. The company was founded in 1993 and is headquartered in Las Vegas, Nevada. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

More value-oriented stocks tend to represent financial services, utilities, and energy stocks. 2 equities research analysts have issued twelve-month price objectives for PennantPark Investment’s stock. On average, they anticipate the company’s stock price to reach $6.25 in the next twelve months. This suggests a possible upside of 21.6% from the stock’s current price. View analysts price targets for PNNT or view top-rated stocks among Wall Street analysts. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.